Clear battle traces are rising between the assorted hybrid cloud market individuals. For each distributors and enterprises, the stakes are excessive and there might be clear winners and losers within the years forward as cloud strikes from hyperbole to an working mannequin.

On one aspect, we’ve the hyperscale cloud suppliers preventing it out for market share in public cloud, however with a noticeable improve in deal with providing on-prem options after which we’ve the server distributors on the opposite aspect, bridging from their put in base of on-premises infrastructure into cloud through hybrid fashions utilizing open supply in addition to legacy virtualization platforms because the pathway to modernized IT structure.

Of all of the dialogue that’s surrounding cloud, I consider essentially the most hotly contested house is delivering options and companies that may allow enterprises to handle, orchestrate, dealer and provision cloud infrastructure. As Infrastructure-as-a-Service pricing continues its race to the underside, cloud distributors are on the lookout for margin and a strategy to carve out stickiness. This can come by way of layers like HCI and PaaS, however I believe the hybrid cloud orchestration layer is the place the good cash is targeted.

Certainly, Pink Hat is the main Linux-based supplier of enterprise cloud infrastructure. It’s been adopted by 90 % of enterprises and has greater than 8M builders. Its OpenShift expertise is a key part of its success, because it gives a solution to simply deploy multi-cloud environments by a full stack management and administration functionality constructed on prime of business normal Kubernetes and deployed in a digital Linux stack.

One attention-grabbing firm to take a look at within the hybrid cloud is IBM, which is clearly pivoting. Let’s discover this pivot in addition to IBM’s obvious technique, competitors and what the corporate should do to succeed going ahead.

IBM introduced Q3 earnings earlier this week (learn my take right here). Whereas the image was stable however not spectacular, what stood out to me was the efficiency of Pink Hat amongst the remainder of the earnings numbers. With Pink Hat being new to IBM on this Q3 incomes cycle it was encouraging to see a ~20% improve within the Pink Hat numbers. This quarter additionally noticed $5 billion in cloud revenues, which is IBM’s greatest cloud income efficiency of the 12 months, and IBM’s 14 p.c development in cloud revenues for Q3 was the corporate’s greatest development in cloud in additional than a 12 months (2Q18: 18% at fixed foreign money).

To me, the early success in Pink Hat reveals market demand and acceptance of IBM’s acquisition of Pink Hat in addition to readability on the corporate more and more turning its consideration away from attempting to compete with AWS or Azure straight, however to be rather more targeted on delivering cloud native purposes that function freely in hybrid atmosphere giving enterprise prospects selection as to the place workloads are in the end deployed. I consider this can be a sound technique and one that may serve IBM effectively, and given the $34 billion-dollar funding made in Pink Hat, the corporate needs to be prudent to point out development.

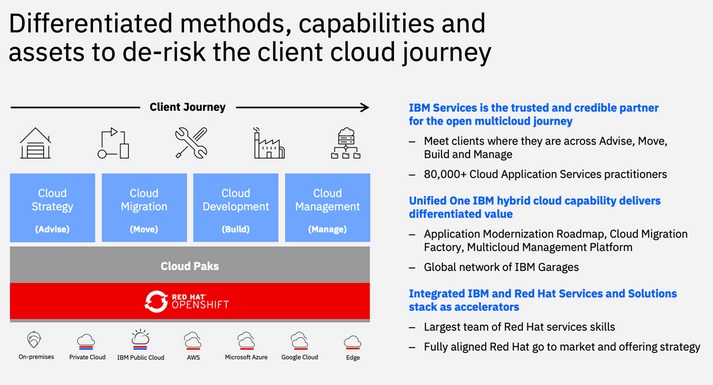

Whether or not this was a byproduct of IBM’s lack of potential to compete within the Hyperscale IaaS market or not, it has turn out to be evident that the corporate would slightly deal with companies, consulting and outsourcing companies that add worth as shopper look to run, handle and function cloud environments; it will gasoline the corporate’s World Companies, Cloud and Pink Hat enterprise models, so the full-service method definitely has advantage given IBM’s strategic income sources.

Moreover, Pink Hat and particularly OpenShift suits completely into this general technique. With OpenStack nonetheless struggling to achieve traction, the deal with Kubernetes and container-based cloud methods has gained early buy-in and fast development of adoption amongst cloud admins is sort of a certainty. The place the cloud admins will in the end flip to orchestrate these new cloud architectures continues to be extra unsure leaving a possible whitespace for IBM.

Pink Hat’s OpenShift platform was a market chief lengthy earlier than IBM got here alongside, and with IBM’s shopper base to promote into and an incentivized IBM gross sales power, I see the Pink Hat software program being extra broadly deployed sooner or later. This might be a race to observe and one which I really feel IBM definitely has the appropriate instrument set to be aggressive. Execution, as at all times would require an in depth eye and I might be watching.

Because the market strikes to a Kubernetes primarily based hybrid cloud orchestration mannequin each on premises and within the public cloud, which instrument you employ to handle your hybrid cloud turns into a key determination for purchasers. Whereas IBM and Pink Hat OpenShift are effectively positioned, sturdy options exist.

One such various is Pivotal from VMware. Having initially spun out of VMware/EMC again in 2012 the cloud vendor re-joined the Dell/EMC/VMware below the Dell Applied sciences fold earlier this 12 months. The Cloud Foundry (Dell Tech) open source-based vendor method has gained traction with enterprise purchasers. Whereas the standalone enterprise had a bumpy trip (dropping $31.7m in its final monetary quarter) the know-how has by no means been in query. I view the mixture of Pivotal Cloud Foundry, VMware and the rising options from Dell Applied sciences Cloud as a direct and formidable competitor to IBM/Pink Hat. The choice level for purchasers might be what your present stack appears like, slightly than a head-to-head of Pivotal vs OpenShift on the know-how degree. And we all know how pervasive VMware is, so the corporate naturally holds a powerful incumbent place inside many accounts.

One other various method for cloud orchestration is OpenStack. The lengthy operating open supply undertaking is about to drop its 20th model, Practice. Whereas OpenShift and OpenStack don’t straight compete, with the previous targeted on PaaS and the afterward IaaS, there’s overlap. OpenStack operates on the compute, storage and networking layer (Converged Infrastructure) and has been a spotlight space for the likes of Rackspace and Chinese language Hyperscaler, Tencent as they’ve developed out their cloud choices.

Nonetheless, not all the pieces is rosy within the OpenStack world. Lengthy standing contributor SUSE just lately introduced they plan to set again from OpenStack and slightly double down on Kubernetes. This was not overly stunning by SUSE however reveals that the brand new SUSE CEO Melissa Di Donato wasted no time in making choices about the place they need to focus going ahead.

The opposite smaller selections available in the market are Docker and Rancher. Docker has had a troublesome time after it exploded available on the market just a few years again because the brains behind containers. They launched model 3 of Docker Enterprise again in April however have struggled to scale organizationally to meet their early promise. Rancher is among the smaller gamers on this market. Having began in 2014 the corporate has targeted on a group method to achieve traction. I’m not solely sure the place these corporations will slot in, however my intuition is that their function is within the small to medium sized shopper house or in enterprises the place purchasers are keen to get palms on. In a 12 months, these orgs could not even be value mentioning.

To get an extra sense on different Hybrid Cloud opponents it could be value testing the aggressive panorama I shared in my latest piece analyzing HPE and Nutanix’s new partnership. Whereas that targeted on HCI, it additionally gave perspective into Cisco, HPE and extra insights on VMware. All of that are creating options to adapt to containers and shifting cloud architectures.

At simply over $3 Billion of income, Pink Hat was not as huge of an organization previous to its acquisition by IBM as many could have thought. Nonetheless, Pink Hat had demonstrated sturdy development and widescale adoption, which led to the choice to spend $34 billion to amass the corporate, regardless that it solely operated in solely ~15 nations. IBM has gross sales power scale and breadth working in 175 nations globally. Gross sales execution by the IBM aspect of the home might be essential going ahead.

One of many methods that IBM is embracing is a bundling method. IBM has now launched what it’s calling “Cloud Paks,” these bundles comprised of IBM middleware embrace an embedded model of OpenShift. These “Cloud Paks” might be essential to IBM’s present prospects as they may allow customers to quickly containerize purposes and simplify supply. I consider that these “Cloud Paks” will catch the attention of the worldwide IBM gross sales power to incorporate of their Enterprise license Agreements with their purchasers. I additionally count on the corporate to scale up its “Cloud Paks” method within the coming months because it appears to roll all of their software program into this supply technique and simplify go to marketplace for the gross sales power.

If IBM is sensible it is going to do all the pieces to ship on the promise Ginni Rometty made on stage at Pink Hat Summit earlier this 12 months, the place she promised to maintain Pink Hat an unbiased unit inside IBM. Huge Blue might want to retain the Pink Hat expertise and make sure the company tradition of Pink Hat perseveres.

The considerably worrisome factor to notice is that Pink Hat had no vital mental property to leverage and was pushed by a wise technical group and an open supply ethos. This mannequin may be very totally different to how the mainline IBM enterprise operates and the best way the tradition is managed might be essential if IBM is to get the worth out of the $34Bn it paid to amass Pink Hat.

It can absolutely be attention-grabbing to observe IBM, and this subsequent huge pivot to hybrid. With the corporate just lately spending $34 Billion on Pink Hat, you might be sure the corporate is just not planning on something however success within the hybrid cloud house. The instruments used to handle these hybrid cloud architectures might be a key determination for purchasers as they appear to maneuver to the subsequent chapter of widespread cloud adoption.